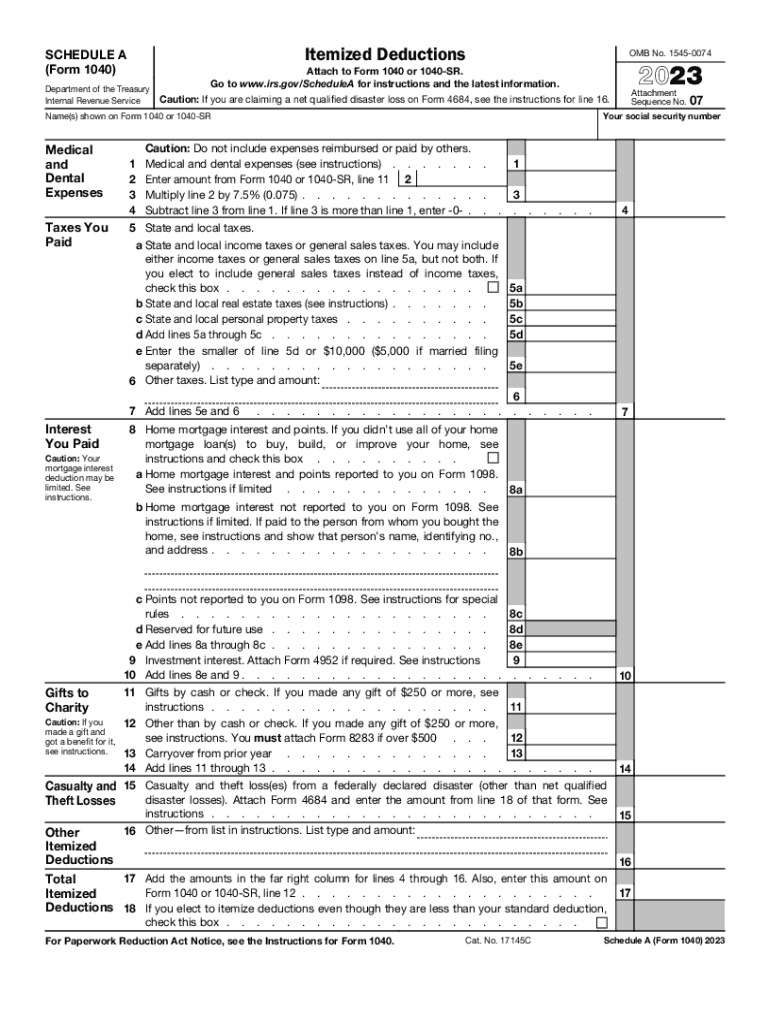

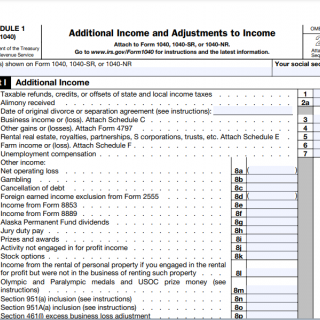

When it comes to filing taxes, the 1040 worksheet is an essential tool that helps individuals calculate their tax liability accurately. The worksheet provides a step-by-step guide for determining taxable income, deductions, and credits, ensuring that taxpayers comply with the IRS regulations and maximize their tax savings.

Whether you are filing as an individual or married couple, the 1040 worksheet serves as a blueprint for organizing your financial information and reporting it to the IRS. By following the instructions on the worksheet, taxpayers can streamline the tax preparation process and avoid errors that may lead to penalties or audits.

What is a 1040 Worksheet?

The 1040 worksheet is a document provided by the IRS to help taxpayers calculate their federal income tax liability. It includes sections for reporting income, deductions, credits, and other relevant information that determine the final tax owed or refund due. By filling out the worksheet accurately, taxpayers can ensure that they are compliant with the tax laws and take advantage of available tax benefits.

One of the key features of the 1040 worksheet is its user-friendly format, which breaks down complex tax calculations into simple steps that anyone can follow. The worksheet provides clear instructions and examples to help taxpayers navigate through the tax filing process with confidence and accuracy.

Additionally, the 1040 worksheet allows taxpayers to see how different factors such as income, deductions, and credits impact their tax liability. By entering the relevant information into the worksheet, individuals can determine the most tax-efficient way to report their financial data and minimize their tax burden.

Overall, the 1040 worksheet is a valuable resource for taxpayers seeking to file their taxes accurately and efficiently. By using the worksheet as a guide, individuals can ensure that they are taking full advantage of available tax deductions and credits while complying with the IRS regulations.

In conclusion, the 1040 worksheet is an essential tool for individuals and couples filing their federal income taxes. By following the instructions provided on the worksheet and entering their financial information accurately, taxpayers can streamline the tax preparation process and maximize their tax savings. Whether you are a first-time filer or a seasoned taxpayer, the 1040 worksheet can help you navigate through the complexities of the tax code and ensure that you file your taxes correctly.