As we approach the tax season for the year 2024, it’s essential for California residents to understand the estimated tax worksheet provided by the state. This worksheet helps individuals calculate how much they need to pay in estimated taxes throughout the year to avoid any penalties or interest. By utilizing this tool, taxpayers can plan ahead and ensure they are meeting their tax obligations.

With the ever-changing tax laws and regulations, staying informed about the latest updates is crucial. The 2024 California estimated tax worksheet provides a clear outline of the calculations needed to determine the correct amount of estimated taxes to pay. Whether you are self-employed, a freelancer, or have other sources of income, this worksheet can help you stay on track with your tax payments.

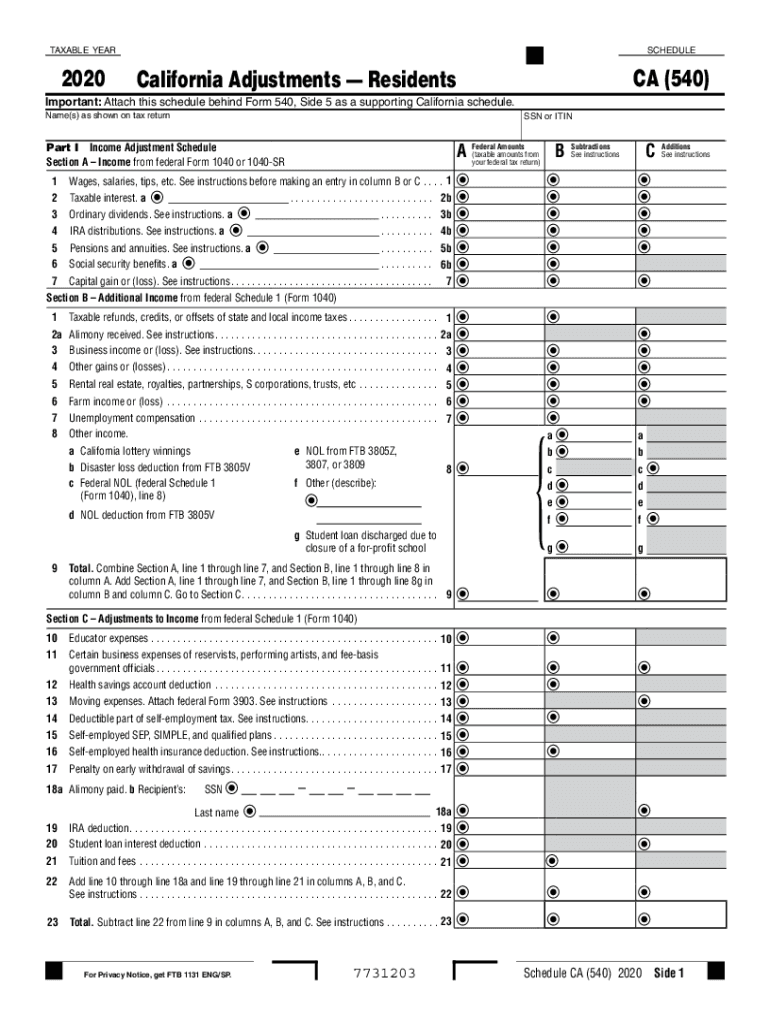

2024 California Estimated Tax Worksheet

The 2024 California estimated tax worksheet includes sections for individuals to input their income, deductions, credits, and other relevant information. By following the instructions provided on the worksheet, taxpayers can calculate their estimated tax liability for the year. This tool is especially useful for those who have fluctuating income throughout the year and want to avoid any surprises come tax time.

One of the key benefits of using the 2024 California estimated tax worksheet is that it helps taxpayers avoid underpayment penalties. By accurately estimating your tax liability and making quarterly payments based on that estimate, you can avoid potential penalties and interest charges from the state. This proactive approach to tax planning can save you time and money in the long run.

It’s important to note that the 2024 California estimated tax worksheet is just a tool to help you calculate your estimated tax liability. It’s always a good idea to consult with a tax professional or financial advisor to ensure you are meeting all of your tax obligations and taking advantage of any available deductions or credits. By staying informed and proactive with your tax planning, you can avoid any unnecessary headaches or surprises when it comes time to file your taxes.

In conclusion, the 2024 California estimated tax worksheet is a valuable resource for individuals looking to stay on top of their tax obligations. By utilizing this tool and staying informed about the latest tax laws and regulations, you can ensure you are meeting your tax obligations and avoiding any potential penalties or interest charges. Take the time to familiarize yourself with the worksheet and consult with a tax professional if needed to make the most of your tax planning efforts.