Managing your finances is an essential part of adulting, and having a budget in place can help you stay on track with your financial goals. One effective way to keep your expenses in check is by using a monthly budget template. While there are many templates available online, having a customizable one that fits your specific needs is key to successful budgeting.

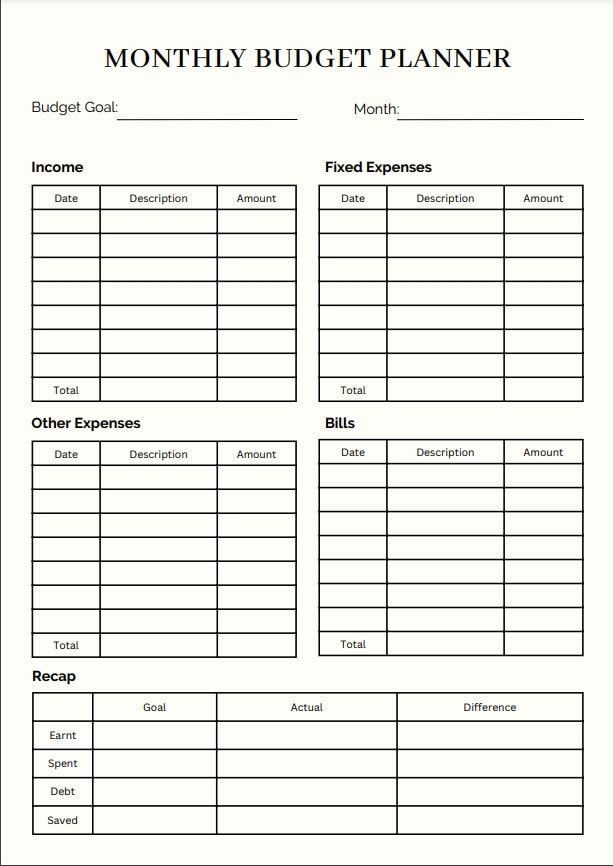

One great resource for a customizable monthly budget template is the free printable version available online. This template allows you to input your income, expenses, and savings goals, giving you a clear picture of your financial situation each month. With the ability to customize categories and amounts, you can tailor the template to fit your unique financial circumstances.

When setting up your monthly budget, start by listing all sources of income, such as your salary, side hustle earnings, or investment returns. Next, outline all of your fixed expenses, including rent or mortgage payments, utilities, and insurance premiums. Once you have your fixed expenses accounted for, factor in variable expenses like groceries, dining out, entertainment, and shopping.

After calculating your total income and expenses, subtract your expenses from your income to determine your discretionary income. This amount can be allocated towards savings, debt repayment, or other financial goals. By regularly tracking your spending and adjusting your budget as needed, you can ensure that you are staying within your financial means and working towards your long-term objectives.

In addition to tracking your income and expenses, it’s important to monitor your progress towards your financial goals. Whether you’re saving for a down payment on a home, planning a vacation, or paying off debt, regularly reviewing your budget can help you stay accountable and motivated. With a customizable monthly budget template, you can easily update your budget categories and amounts to reflect any changes in your financial situation.

In conclusion, having a personalized monthly budget is an effective tool for managing your finances and achieving your financial goals. By utilizing a free printable customizable template, you can create a budget that aligns with your income, expenses, and savings objectives. With regular monitoring and adjustments, you can stay on track with your budget and make informed financial decisions for a secure financial future.