Managing your family’s finances can be a challenging task, especially when you have multiple expenses to keep track of. One of the best ways to stay on top of your finances is by creating a budget. A budget helps you allocate your income towards essential expenses, savings, and other financial goals. To make this process easier, you can use a free printable family budget worksheet.

A family budget worksheet is a tool that helps you track your income and expenses, set financial goals, and monitor your progress towards them. By using a budget worksheet, you can identify areas where you may be overspending and make necessary adjustments to stay within your financial limits. There are many free printable family budget worksheets available online that you can use to get started on your budgeting journey.

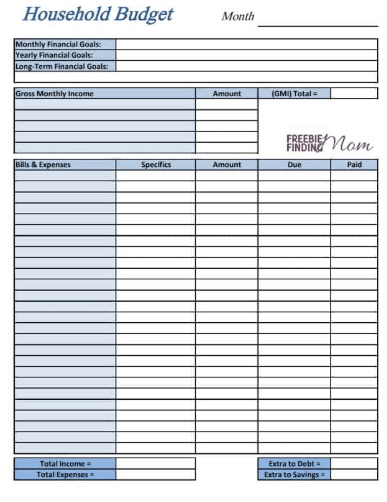

When using a family budget worksheet, it’s important to list all sources of income, such as salaries, bonuses, and any other additional income. Next, you should list all your expenses, including fixed expenses like rent or mortgage payments, utilities, groceries, and transportation costs. Variable expenses like entertainment, dining out, and clothing should also be included to get a comprehensive view of your spending habits.

After listing your income and expenses, you can calculate your total income and subtract your total expenses to determine if you have a surplus or a deficit. If you have a surplus, you can allocate the extra funds towards savings or paying off debt. If you have a deficit, you may need to reevaluate your expenses and find ways to cut back in certain areas.

Regularly reviewing and updating your family budget worksheet is essential to ensure that you are staying on track with your financial goals. By monitoring your progress and making adjustments as needed, you can achieve better financial stability and peace of mind for your family.

In conclusion, using a free printable family budget worksheet is a practical way to manage your finances and work towards your financial goals. By taking the time to create a budget and track your income and expenses, you can make informed decisions about your money and ensure that your family’s financial future is secure.