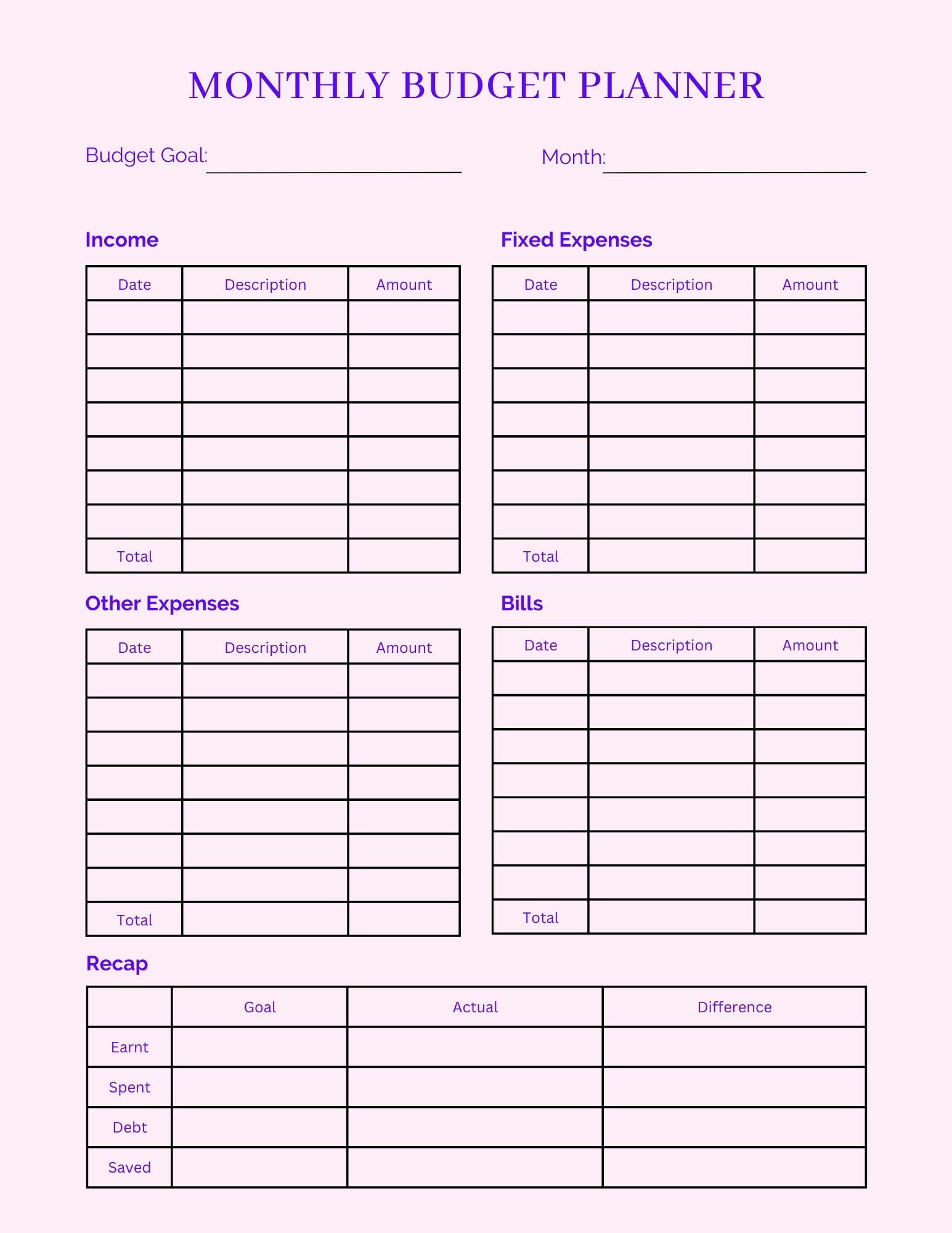

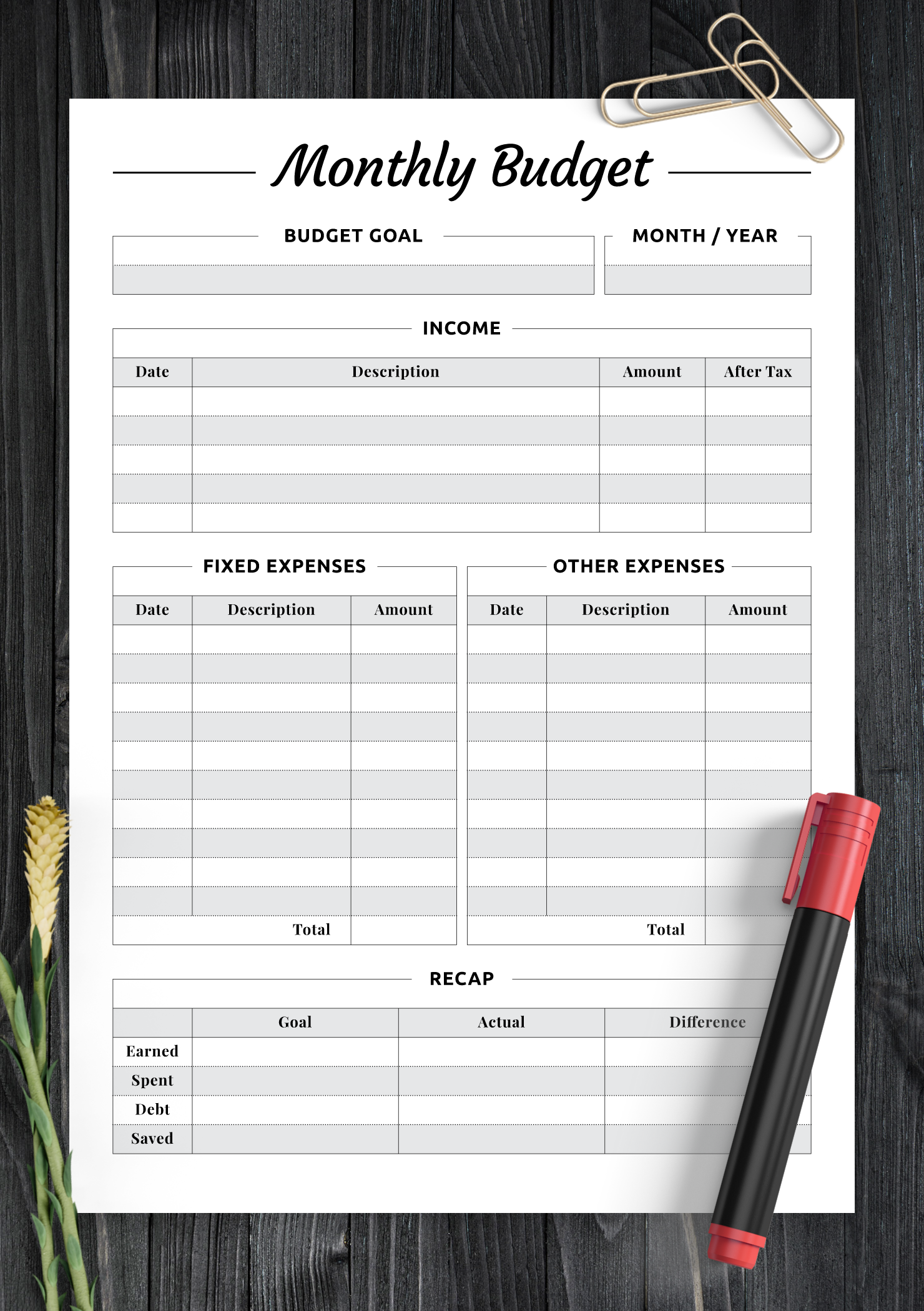

Keeping track of your finances is essential for maintaining a healthy financial future. One of the most effective ways to manage your money is by using monthly budget sheets. These sheets help you track your income, expenses, and savings, allowing you to make informed decisions about your finances.

By creating a monthly budget sheet, you can see where your money is going each month and identify areas where you can cut back on expenses or increase savings. This can help you reach your financial goals faster and avoid unnecessary debt.

Benefits of Monthly Budget Sheets

One of the main benefits of using monthly budget sheets is that they provide a clear and organized way to track your finances. By recording your income and expenses each month, you can easily see how much money you have coming in and going out. This can help you avoid overspending and ensure that you are living within your means.

Monthly budget sheets also allow you to set financial goals and track your progress over time. By comparing your actual expenses to your budgeted amounts, you can see where you may be overspending and make adjustments as needed. This can help you save money for important expenses, such as a vacation or a new car, and build a solid financial foundation for the future.

In addition, monthly budget sheets can help you plan for unexpected expenses and emergencies. By setting aside a portion of your income each month for savings, you can create a financial cushion to cover any unforeseen costs that may arise. This can provide peace of mind and help you avoid financial stress in difficult times.

Overall, monthly budget sheets are a valuable tool for managing your finances and achieving your financial goals. By tracking your income, expenses, and savings each month, you can make informed decisions about your money and ensure that you are on the right path to financial success.

Start using monthly budget sheets today to take control of your finances and build a secure financial future for yourself and your family.