When it comes to filing your taxes, TurboTax is a popular choice for many individuals and businesses. One of the features that sets TurboTax apart is its carryover worksheet, which allows users to easily transfer information from previous years’ tax returns. This can save time and ensure accuracy when preparing your taxes.

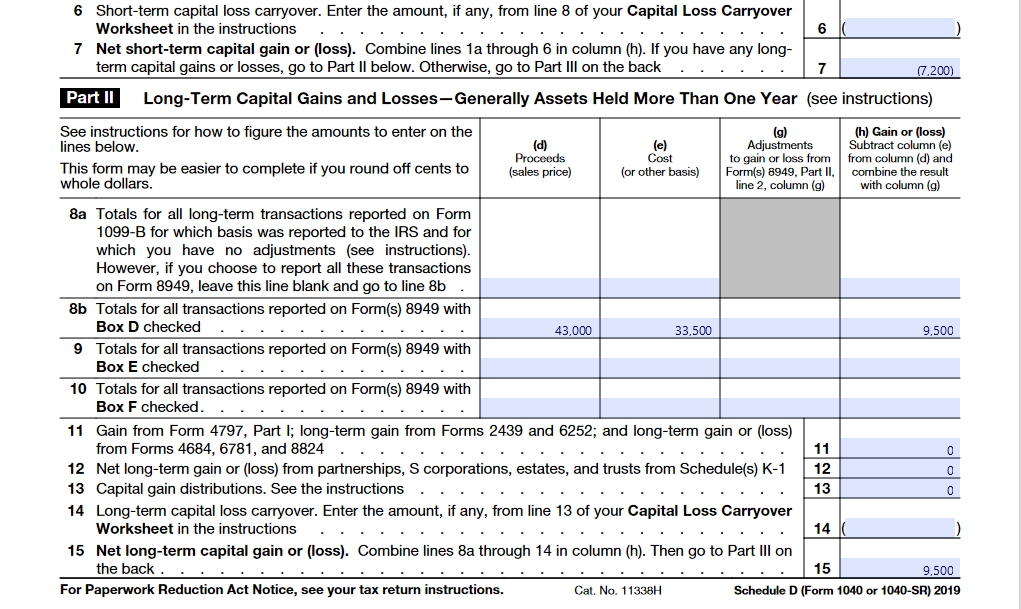

With the carryover worksheet in TurboTax, you can seamlessly carry over information such as capital losses, charitable contributions, and more from one year to the next. This feature is especially helpful for individuals who have investments or other complex financial situations that may require information from previous tax returns.

When using the carryover worksheet in TurboTax, it’s important to carefully review the information that is being carried over to ensure accuracy. You can easily edit any information before finalizing your tax return to make sure everything is correct and up to date.

Another benefit of the carryover worksheet in TurboTax is that it can help you maximize deductions and credits by ensuring that you are not missing any important information from previous years. This can result in a significant savings on your tax bill and help you get the most out of your tax return.

In conclusion, the carryover worksheet in TurboTax is a valuable tool for individuals and businesses looking to streamline the tax filing process and ensure accuracy in their returns. By taking advantage of this feature, you can save time, maximize deductions, and avoid costly errors. So next time you’re preparing your taxes with TurboTax, be sure to make use of the carryover worksheet for a smoother and more efficient filing experience.