Capital Gains Tax (CGT) is a tax on the profit or gain made when you sell an asset that has increased in value. It is important to accurately calculate and report your CGT to ensure compliance with tax laws and avoid penalties. A CGT worksheet can help you keep track of your gains and losses, making the process easier and more efficient.

By using a CGT worksheet, you can organize and document all the necessary information related to your capital gains and losses. This includes details such as the date of purchase, sale price, cost of acquisition, and any expenses incurred during the transaction. Having all this information in one place can streamline the process of calculating your CGT liability and ensure accuracy in your tax return.

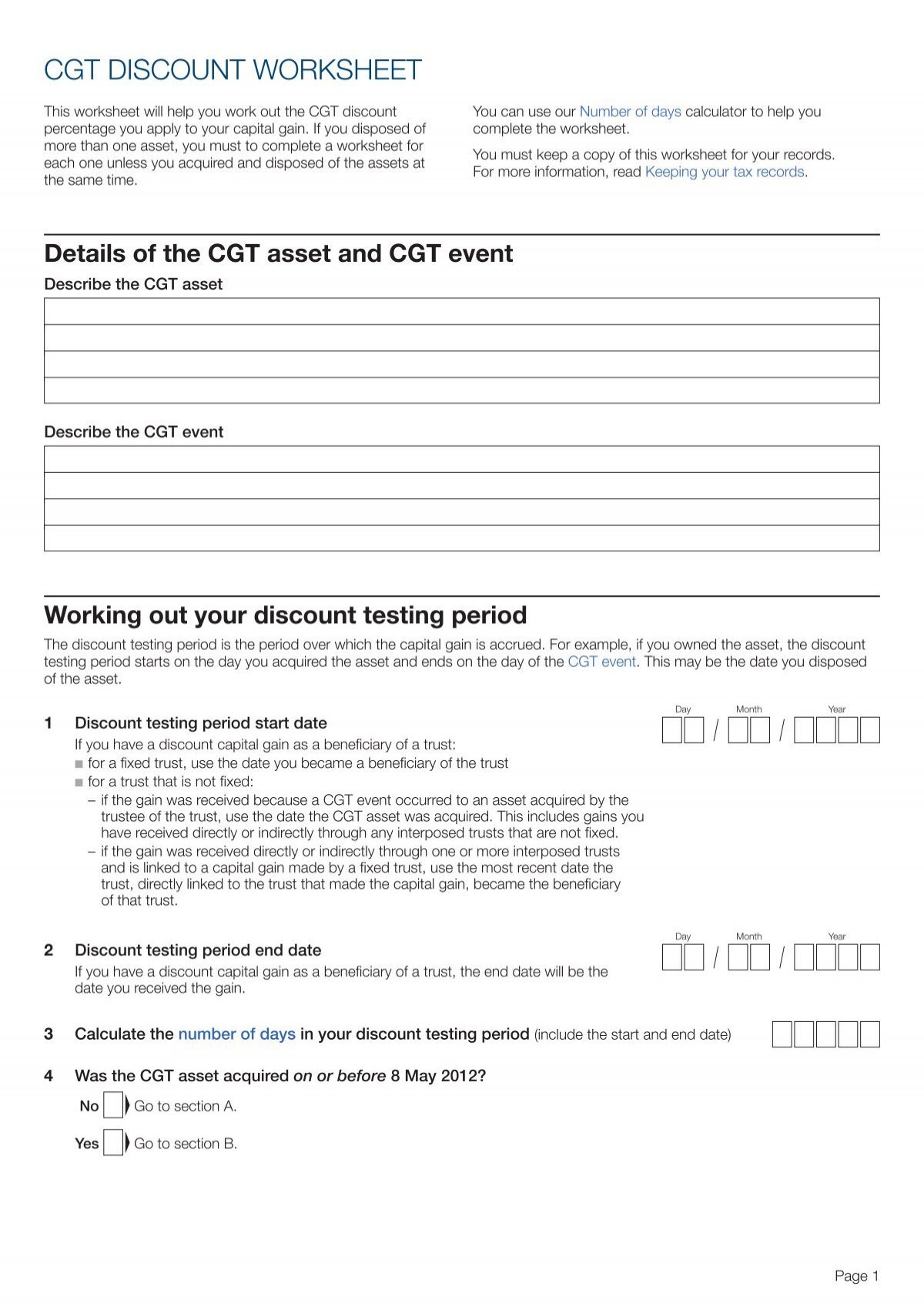

CGT Worksheet

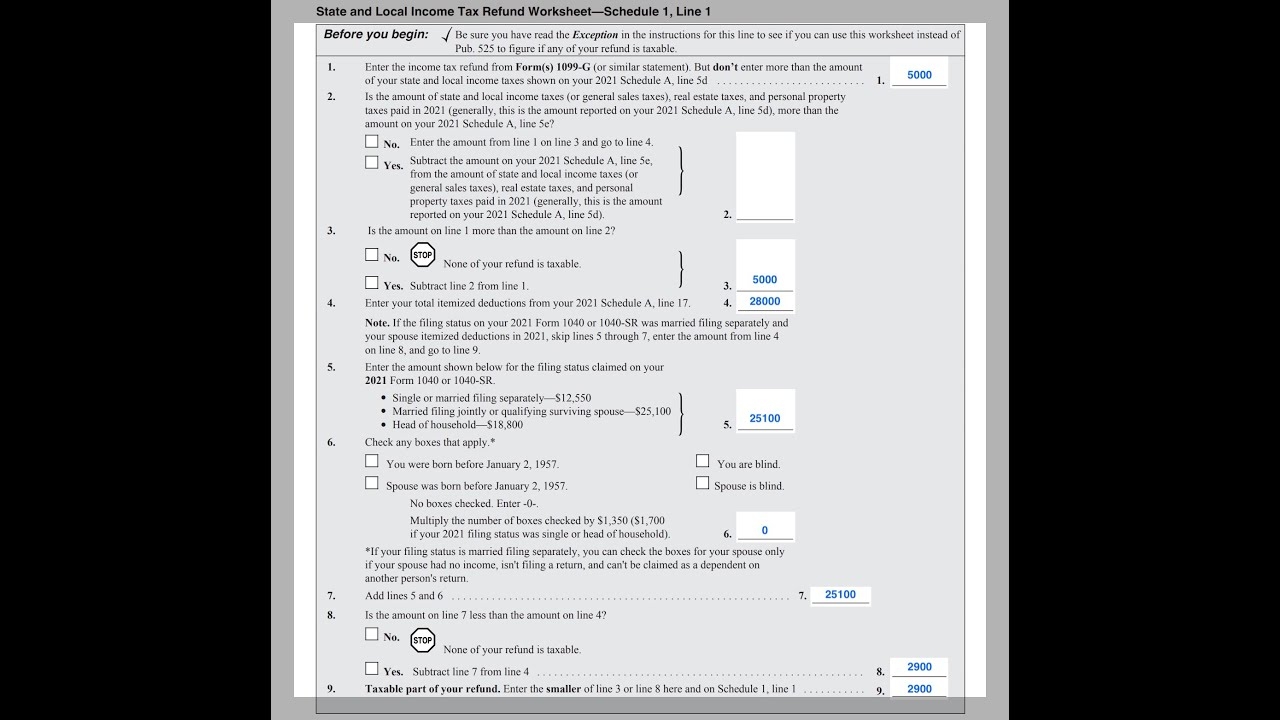

A CGT worksheet typically consists of a series of columns and rows where you can input the relevant data for each asset or investment. This may include details such as the description of the asset, date of acquisition, date of sale, sale price, cost base, and any capital gains or losses incurred. By filling out this worksheet for each transaction, you can easily track your capital gains and losses over time.

Additionally, a CGT worksheet can help you assess the impact of different investment decisions on your overall tax liability. By recording and analyzing your capital gains and losses, you can identify strategies to minimize your CGT exposure and optimize your tax position. This can be particularly useful for investors with multiple assets or investments in their portfolio.

In conclusion, a CGT worksheet is a valuable tool for managing your capital gains and losses effectively. By using this worksheet to track and document your transactions, you can ensure compliance with tax laws, accurately calculate your CGT liability, and make informed decisions to optimize your tax position. So, whether you are a seasoned investor or just starting out, consider using a CGT worksheet to simplify the process of managing your capital gains tax.