Managing your finances can be a daunting task, but it doesn’t have to be. By creating a budget and sticking to it, you can take control of your money and reach your financial goals. One of the best ways to start budgeting is by using a simple printable budget worksheet. This tool can help you track your income and expenses, identify areas where you can cut back, and save for the future.

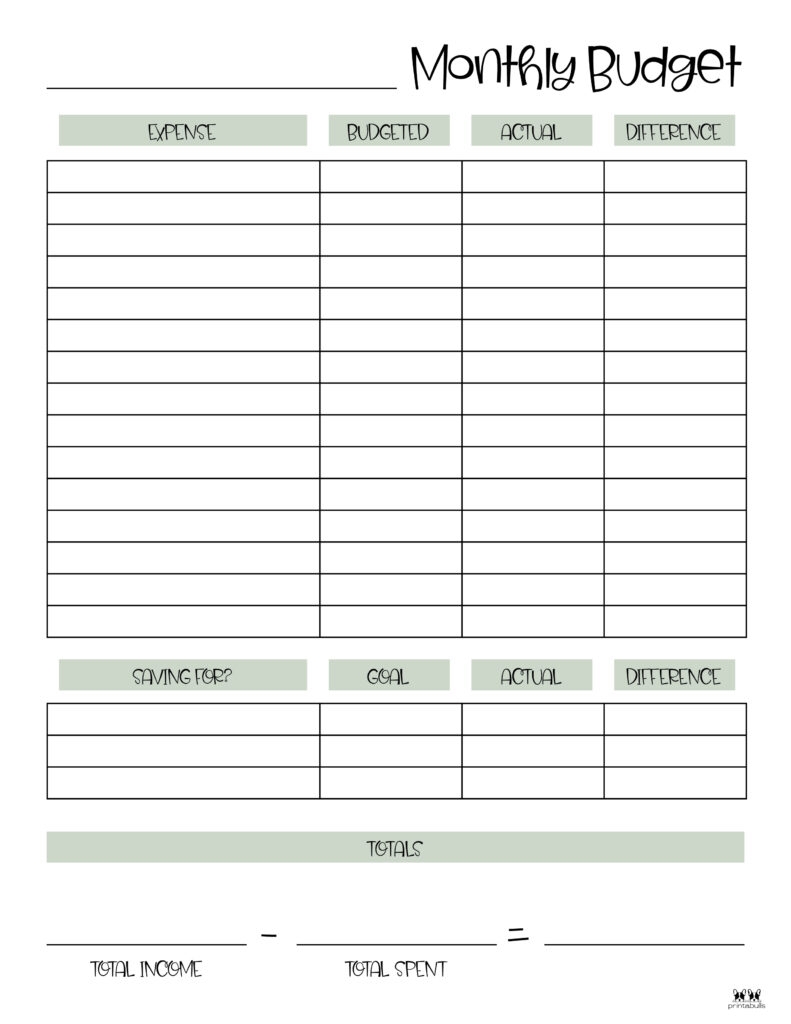

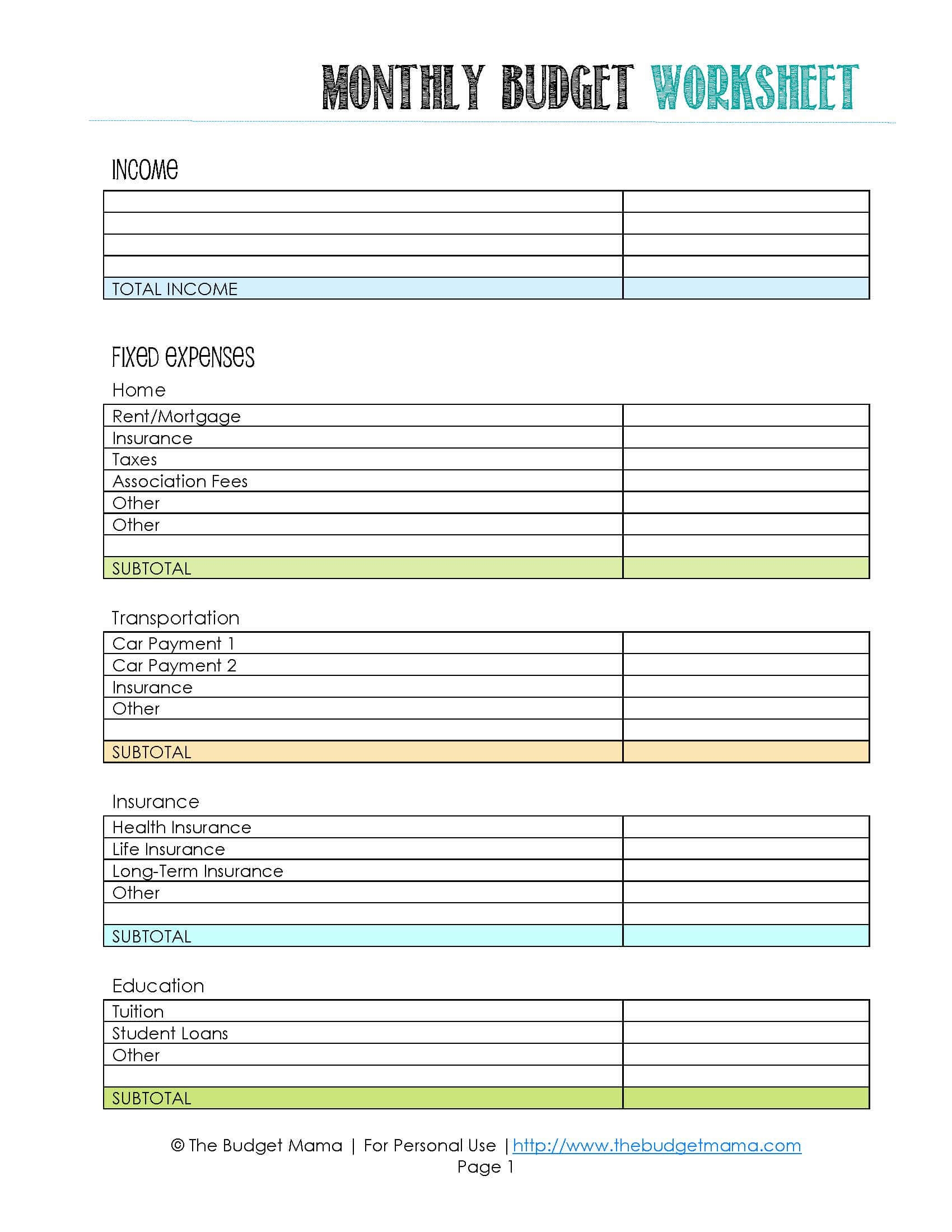

There are many free resources available online that offer simple printable budget worksheets. These worksheets typically include categories for income, expenses, and savings goals. They are easy to use and can be customized to fit your specific financial situation. By filling out the worksheet each month, you can see where your money is going and make adjustments as needed.

When using a budget worksheet, it’s important to be honest and accurate with your numbers. Include all sources of income, from your paycheck to any side hustles or freelance work. List out all of your expenses, including bills, groceries, and entertainment. Be sure to also set aside a portion of your income for savings and emergencies. This will help you build a financial cushion and avoid living paycheck to paycheck.

As you continue to track your spending with the budget worksheet, you may notice patterns or areas where you can cut back. For example, you might see that you’re spending too much on dining out or shopping. By making small adjustments to your spending habits, you can free up more money to put towards your savings goals. Over time, these changes can add up and help you achieve financial stability.

In conclusion, using a simple printable budget worksheet is a great way to take control of your finances and work towards your financial goals. By tracking your income and expenses, you can make informed decisions about where to allocate your money and save for the future. So why wait? Start using a budget worksheet today and see the positive impact it can have on your financial well-being.